Just when we thought things couldn’t get more unexpected than a pandemic that shut down the world in 2020, 2021 entered the chat.

As we started to navigate a “new normal,” we also started challenging the systems around us with advancements in crypto, web3, the metaverse and so much more.

When looking at our top-performing stories of the year, a lot stood out. Some stories were to be expected, like product launches and major outages (ahem, Facebook). Others were deep analyses and interviews on different sectors of the industry. It was hard to narrow down a top 10.

Instead of spitting out a list of TechCrunch’s top-performing stories, we asked our staff to vote on their favorite stories of the year, added evergreen content and our top TC+ articles for a well-rounded 2021 list. Enjoy!

Staff picks

1. Air conditioning is one of the greatest inventions of the 20th Century. It’s also killing the 21st

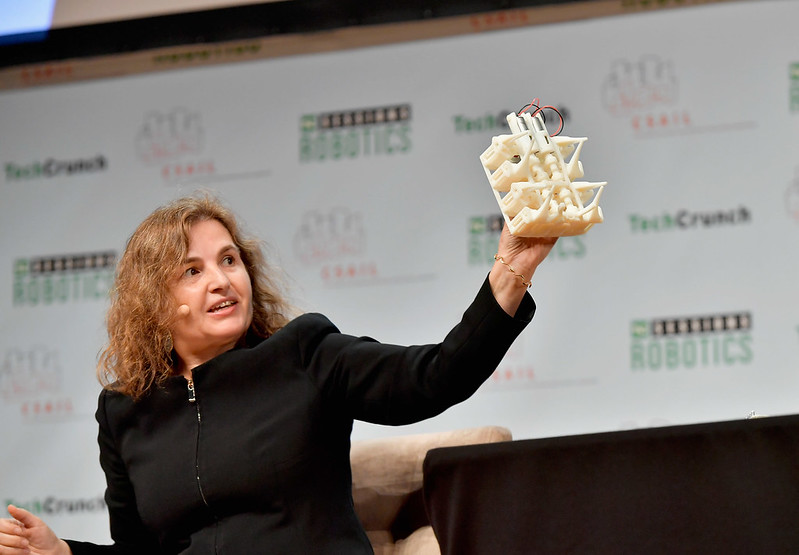

What started as a small Twitter Spaces interview with about 180 listeners quickly (and very unexpectedly) turned into one of TechCrunch’s top-read stories of 2021. Danny’s book reviews gained traction this year, but nothing piqued readers’ interests (see the comments for proof) quite like unpacking the modern-day air conditioner. Danny’s Spaces interview with Eric Dean Wilson focused on his book “After Cooling: On Freon, Global Warming, and the Terrible Cost of Comfort,” exploring the before, during and after story of A/C — and how damaging the comforts of cold, clean indoor air can actually be.

2. OnlyFans’ porn ban is crypto’s opportunity of a lifetime

Twitter erupted when OnlyFans announced its ban on “sexually explicit content” in mid-August in an attempt to comply with its investors and banks. At the time, the decision left creators feeling betrayed, and experts questioned if OnlyFans could even survive the transition. Although the decision has since been suspended, the tech community’s immediate solution to the ongoing regulatory issues the porn industry faces was simple: crypto. For those of you new to the world of crypto, this real-world antidote will help you understand the “why” behind the push for cryptocurrencies. And for those of you well-versed on the topic, Lucas weighs both the opportunities and potential challenges crypto and porn face.

3. Elon Musk said it was ‘Not a Flamethrower’

This is probably our “most 2021” headline. Many of us are — maybe a little too much — accustomed to the Tesla CEO’s name in headlines for wacky, meme-like behavior or commentary. But what makes this story interesting is the real-life dangers behind Musk’s money-spinning gag products. Musk sold a limited run of flamethrowers back in 2017 in an effort to raise awareness and funds for his startup, The Boring Company, which launched in 2016. However, Musk knew various countries had a ban on flamethrowers and thus labeled the product “Not a Flamethrower.” Problem solved? Not even close. TechCrunch contributor Mark Harris highlights an American who was incarcerated in Italy for the possession of Not a Flamethrower.

4. Medium sees more employee exits after CEO publishes ‘culture memo’

It’s safe to say this year brought much disruption to today’s corporate ecosystem. Not only are employees challenging work-life balance, the wealth gap and company culture, but they are also taking a stance on social and political initiatives. Natasha spoke with various former and current employees at Medium after CEO Ev Williams posted a “culture memo,” which ended up tripling churn at the company. However, after speaking to one engineer, Natasha found that there has been a long-standing “history of problematic issues at Medium, with a wave of departures that seem to be clearly triggered by the memo.” This article not only explores the downfall of Medium’s company culture but also how it relates to companies who sent out similar memos, like Coinbase and Basecamp.

5. TikTok just gave itself permission to collect biometric data on US users, including ‘faceprints and voiceprints’

TikTok took off in the thick of the pandemic as many people in 2020 turned to the platform for their daily dose of viral videos, dances and trends while in quarantine. However, now more than ever, social media users are aware of data collection as growing concerns of privacy rights emerge. TikTok changed its privacy policy in June to allow the capture of users’ biometric data, which includes faceprints and voiceprints. At first glance, the new privacy policy is on par with many other social networks’ use of data collection. But Sarah breaks down why the new policy is alarming, TikTok’s history with the U.S. government, past biometric privacy violation lawsuits and the policy update’s buggy rollout. This article is a good starting point for the ongoing data-privacy issues social media users face.

Best evergreen

With only a few days left in 2021, we looked back to see what we covered this year that we can continue to learn from in the future. NFTs aren’t going anywhere, yet, so that was at the top of our evergreen list, along with privacy laws, how Zoom effects your brain and how lessons in growth marketing from Cam Sinclair director of Ammo, a Perth-based growth marketing agency.

1. If you haven’t followed NFTs, here’s why you should start

This new(ish) wave of crypto has grown exponentially over the past year. When Cooper Turley wrote this article in February 2021, he said, “The estimated total value of crypto art has now passed $100 million according to cryptoart.io/data — just one vertical of a growing ecosystem of NFTs.” The estimated total value now, December 2021, is over $2 billion. If you don’t know much about NFT’s, this article is a great starting point.

2. This tool tells you if NSO’s Pegasus spyware targeted your phone

Are you concerned that your phone was targeted by NSO’s spyware? You probably shouldn’t be, but in July of 2021, a list was leaked that contained, “50,000 phone numbers of potential surveillance targets was obtained by Paris-based journalism nonprofit Forbidden Stories and Amnesty International and shared with the reporting consortium, including The Washington Post and The Guardian.” Zack writes about how Pegasus can be delivered and how you can tell if your phone has been targeted.

3. New York City’s new biometrics privacy law takes effect

In July of 2021, Zack also reported on a new biometric law taking effect in New York City. This law limits what businesses can do with the biometric data they collect. Zack says, “The move will give New Yorkers — and its millions of visitors each year — greater protections over how their biometric data is collected and used, while also serving to dissuade businesses from using technology that critics say is discriminatory and often doesn’t work.”

4. This is your brain on Zoom

We’ve all been working from home, faces seen by colleagues on endless video chats, so it was great to read Devin Coldewey’s breakdown of a study Microsoft conducted about how your brain needs a break. When discussing the study, Devin says, “During the meeting block with no breaks, people showed higher levels of beta waves, which are associated with stress, anxiety and concentration.” Here’s to scheduling meeting breaks in 2022!

5. Australian growth marketing agency Ammo helps startups calibrate their efforts

TechCrunch Experts launched this year with the first focus being growth marketing. Anna Heim interviewed Cam Sinclair, Ammo’s director, and they talked about when companies are ready for growth marketing, mistakes to avoid when branding and more. Sinclair says, “At Ammo, we don’t measure time, we measure outcomes. At the start of every project we define what success looks like with the client. Every client is different, and we’re responsive to that.”

TC+ Favorites

1. Subscription-based pricing is dead: Smart SaaS companies are shifting to usage-based models

Kyle Poyar, partner at OpenView, contributed this article about usage-based pricing models in January of 2021. Poyar says, “Usage-based pricing will be the key to successful monetization in the future.” The article continues with four tips to help companies with this model. While we don’t want to give all of the tips away in this summary, one of the tips that Poyar writes about is picking the right usage metric.

2. Nubank’s IPO filing gives us a peek into neobank economics

In November, Alex and Natasha wrote about Nubank’s IPO filing, focusing on the economics of neobanking and Nubank’s financial health. If you want to take a deeper dive into Nubank, you can read Marcella McCarthy and Danny Crichton’s TC-1 here.

3. How does former Better.com CEO Vishal Garg still have a job?

Mary Ann was busy in the month of December, with one of her focuses being news from Better.com (like when they laid off 9% of their staff). While it would take a lot to shock Mary Ann and Alex, especially after this, they were surprised that Garg hadn’t been asked to completely step down. They said, “Some surmised that he had super-voting shares and thus could vote to keep himself in the role of CEO despite what others voted. But after digging into the S-4 filed by Better.com’s SPAC partner, Aurora Acquisition Corp., in November, we realized that is not the case.”

4. How should SaaS companies deliver and price professional services?

Roger Hurwitz, a founding partner at Volition Capital, contributed an article about how to charge for professional services and why that pricing may be different from other SaaS strategies. Hurwitz compares a three-year impact of two pricing strategies in this article.

5. 5 critical pitch deck slides most founders get wrong

Jose Cayasso, co-founder and CEO of Slidebean, reviews “250 to 300 investor decks every single month” and uses this experience to teach others what the must-haves are for a slide deck. His first suggestion is a go-to-market slide, and he includes why and where in the deck it should appear with an example of one in the full article.

from https://ift.tt/3eAm411

via

Technews