Welcome to The Interchange! If you received this in your inbox, thank you for signing up and your vote of confidence. If you’re reading this as a post on our site, sign up here so you can receive it directly in the future. Every week, I’ll take a look at the hottest fintech news of the previous week. This will include everything from funding rounds to trends to an analysis of a particular space to hot takes on a particular company or phenomenon. There’s a lot of fintech news out there and it’s my job to stay on top of it — and make sense of it — so you can stay in the know. — Mary Ann

Storied venture firms Sequoia Capital and Andreessen Horowitz (a16z) invested more in fintech than any other category in 2022, according to research from CB Insights. I’m not going to lie — upon learning this, my fintech-loving ears perked up.

Sequoia apparently was fairly active overall last year despite the global downturn, with over 100 investments. And fintech represented nearly a quarter of the firm’s deals.

We saw a similar trend at a16z. According to CB Insights, of the 206 deals that a16z participated in last year, almost a quarter went to fintech companies — more than any other industry. Sixty percent of these fintech investments closed in the first half of 2022, with the remainder closing in the second half of the year.

Sequoia backed 25 companies in the financial services space last year. Its top three fintech targets, as identified by CB Insights, were capital markets, payments and payroll and benefits — with each category representing 16% of its investments.

A16z backed 49 companies in the fintech space last year and its top three fintech targets were payments (28%), blockchain (22%) and digital lending (12%).

Three out of Sequoia’s four deals in the capital markets space were follow-on investments, a reflection of the firm’s “faith in the future of capital markets tech,” noted CB Insights. Deals it participated in included Citadel Securities’ $1.2 billion round; Capitolis’ $110 million Series D; Watershed’s $70 million Series B; and Ledgy’s $22 million Series B.

More than a quarter (28%) of a16z’s fintech investments in 2022 went to the payments category. For example, it participated in SpotOn’s $300 million Series F; Jeeves’ $180 million Series C; and Tally Technologies’ $80 million Series C.

Meanwhile, Sequoia’s investments in payments tech companies spanned both consumer and business payments and operate in four distinct markets: buy now, pay later (BNPL), expense management, peer-to-peer (P2P) payments, and online payments acceptance. Two of the four deals are at the seed stage. Specifically, Sequoia participated in Klarna’s $800 million financing; Yokoy’s $80 million Series B; Telda’s $20 million seed round; and Cococart’s $4 million seed financing.

While blockchain and crypto arguably fall under the fintech category, I usually leave analysis of those segments to our crypto team, so I won’t go into a16z’s blockchain investments. But a16z’s third most popular fintech category in 2022 was digital lending companies, with the firm having participated in Point Digital Finance’s $115 million Series C; Valon’s $60 million Series B; and Vesta’s $30 million Series A.

Sequoia’s third most popular category was payroll and benefits, with the firm having backed four such companies — all at later stages — and participating in CaptivateIQ’s $100 million Series C; Rippling’s $250 million Series D; Remote’s $300 million Series C; and Truework’s $50 million Series C.

Now, we know that investments in fintech companies were far lower in 2022 compared to 2021. But wasn’t that true for every sector? Sequoia’s and a16z’s continued bets in the space are just one indication that fintech may be down, but definitely not out.

Weekly News

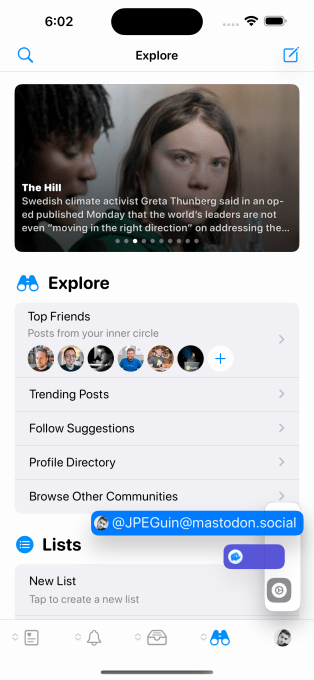

I interviewed Klarna CEO and co-founder Sebastian Siemiatkowski about the Swedish payment giant’s momentum in the U.S. Highlights of the interview, which you can read about in more detail here, include (1) the fact that the U.S. has overtaken Germany as Klarna’s largest market by revenue, (2) the company’s fastest-growing revenue stream is actually marketing, not BNPL and (3) Sebastian really views Klarna and Affirm as being “very different” companies in terms of loan duration and amount. On the topic of Klarna and Affirm, I also spoke this past week with Tyson Hendricksen, CEO and founder of a new company called Notice that tracks secondary market trade activity in the private markets. He told me that based on secondary market activity, Klarna appears to be currently valued at around $7.5 billion, which is actually higher than the $6.7 billion it was valued at last July, but also still significantly lower than the $45 billion it was valued at in 2021. By comparison, Affirm is currently valued at $3.84 billion. Below is a chart Hendricksen provided that illustrates trading activity at the two companies. Affirm is public so the chart shows share price as recorded in the public markets. It also shows a composite price for Klarna that takes into account secondary market trades and open bids and offers. Says Hendricksen: “Think of it as an approximation of the current stock price and valuation using multiple private market data sets.”

To view it more interactively, click here.

Image Credits: Notice

Reports Tage Kene-Okafor: “African cross-border payments platform Chipper Cash conducted a second round of layoffs…just 10 weeks after it cut approximately 12.5% of its workforce (affecting its engineering team the most). The company’s VP of revenue shared the news on LinkedIn, saying “all areas” across Chipper Cash’s markets were impacted this time. “Friday was a sad day for Chipper Cash, as many talented people were let go,” his post read. More here.

Reports Manish Singh: “India and Singapore have linked their digital payments systems, UPI and PayNow, to enable instant and low-cost fund transfers in a major push to disrupt the cross-border flow of money between the two nations that amounts to more than $1 billion each year.” More here.

Reports Ingrid Lunden: “Stripe, the payments and financial services upstart, made waves in the world of mobile commerce last year when it became Apple’s first payment partner for “Tap to Pay,” the iPhone giant’s move to turn any iOS device into a payment-making or payment-taking terminal. Now, Stripe is expanding that business by a factor of googol. From today, businesses that use Stripe Terminal to take in-person payments now will be able to carry out Tap to Pay transactions on NFC-equipped Android devices, too.” More on that here.

MagicCube co-founder Sam Shawki points out in an email interview with me that Stripe is actually not the only payments company providing Tap to Pay on Android currently. He says that his startup, MagicCube, was first to market with Tap to Pay on Android devices in 2021 in the U.K., which has been transacting for a while now. Adds Shawki: “Since then we have many deployments around the world and a few new deployments in the US coming up shortly with major processors in the US, Canada and EMEA that are using Apple on iOS and MagicCube on Android.…We welcome Stripe to the market as it confirms our vision and lights the fire under other processors, merchant acquirers, and financial institutions to more quickly move to adoption in order to maintain their market share. We believe that this year will be the year of massive shift to using our product on Android and on Apple’s iOS to capture the $140 billion a year opportunity of Tap to Phone.” I wrote about MagicCube in 2021 here.

Samantha “Sam” Eisler has joined Lightspeed Venture Partners’ NYC fintech team. Prior to Lightspeed, which she joined in late 2022, Eisler was an investor at Tusk Venture Partners, where she focused on investments in fintech and digital health. Prior to that, she spent five years at Google, working on go-to-market strategies for the company’s machine-learning-driven ad solutions, as well as helping to build an accelerator program for startups in emerging markets. More here.

Reports Bloomberg: “JPMorgan Chase & Co. has curbed its staff’s use of the ChatGPT chatbot, according to a person familiar with the matter. The artificial intelligence software is currently restricted, the person said, who asked not to be identified because the information is private. The move, which impacts employees across the firm, wasn’t triggered by any specific incident.”

Varo Bank announced the appointment of Wook Chung as chief product officer. A statement from a spokesperson said that Chung will lead Varo’s product vision and strategy initiatives and will play a key role in the expansion of Varo Tech, the innovation arm of the company, “which meets at the intersection of product, technology, data, and design.” According to Varo, Chung has an “extensive background” in product management through roles at Facebook, Twitter, Google, and most recently SoFi. More here.

Across the sea, as reported by Silicon Canals, “Amsterdam-based challenger bank Bunq announced on Tuesday, February 21, that it has reached a pre-tax profit of €2.3M in the last quarter of 2022. In Q4 2022, Bunq’s net fee income grew by 37 per cent compared to Q4 2021, and user deposits grew by 64 per cent compared to €1.8B at the end of 2022.” More on Bunq here.

Mastercard has tapped five startups to participate in its Start Path Emerging Fintech program. Here are the five startups, as described by the credit card giant: EMERGE Esports (Singapore) provides its network of gaming content creators and brands across Southeast Asia with commercialization options through its talent database. Mintoak (India) provides a software-as-a-service platform that enables banks to expand their value proposition for merchants through payment acceptance and commerce enablement solutions. Optty (Singapore) offers a single integration and orchestration solution that connects merchants directly to buy now, pay later solutions; wallets; and other alternative payment methods globally. PayCaddy (Panama) offers an all-in-one banking-as-a-service solution for digital banking and express card issuance. Finally, Prosperas (United States) enables lenders to deliver credit opportunities directly to a mobile phone using anonymized, nonbiased data to match and prequalify consumers.

Rob Galtman, senior director of Fitch Ratings, noted that Block (formerly known as Square) had a “solid” Q4 despite macro- and recession-related fears. Via email, he added that the company is among other large tech players that have focused more on profitability in light of tougher capital market conditions, with management revealing slower hiring trends in 2023. Galman added: “Market concerns around BNPL are not evident to date, with loan loss rates remaining low. However, BNPL remains an area to focus on, given low-income consumers are especially pressured with inflation pressures. If a recession or macro pullback arrives, Block is well positioned given exposure to secular growth areas including digital payments and omnichannel commerce, as well as a strong balance sheet.”

Opendoor Technologies continues to face challenges. As reported by Barron’s: The real estate tech company “reported a narrower fourth-quarter loss than expected after the market closed on Thursday, February 23. The earnings beat caps a year of change in both the housing market and the company, which buys and sells houses. Opendoor (ticker: OPEN) said it lost 63 cents per share on revenue of about $2.9 billion in the quarter, beating consensus estimates…In full-year 2022, Opendoor lost $2.16 per share on revenue of about $15.6 billion. Consensus had anticipated a loss of $2.33 on sales of roughly $15.2 billion. While the fourth-quarter results beat estimates, they were down significantly from year-ago levels. The company lost 31 cents per share on sales of about $3.8 billion in the final quarter of 2021.”

Fundings and M&A

Seen on TechCrunch

YC-backed HR-payroll provider Workpay raises $2.7M to scale in Africa

Nestment raises $3.5M to help friends and family buy homes together

Trust & Will secures $15M after doubling revenue: Amex Ventures, USAA are among the digital estate planning startup’s new backers

Telecom giant Airtel eyes a stake in Paytm

And elsewhere

Marijuana fintech firm Green Check Verified raises $6 million

Mexican startups Minu and Plerk merge to strengthen the benefits market. TechCrunch covered Minu’s recent raise here.

Goldman Sachs’ One Million Black Women and Now®️ launch $225M credit facility to accelerate growth of small and historically underserved businesses. TechCrunch covered Now’s 2021 raise here.

Nuvei finalizes $1.3B Paya purchase

Fintechs that are hiring

The good news is that I was inundated with DMs and emails from people letting me know that their fintech company is hiring. The bad news is that there is no way I can include all of them in this week’s newsletter. So if you reached out and don’t see your company here, check out upcoming editions of The Interchange. I’m making my way down the list!

- Mesh Payments has about a dozen openings; the financial management startup announced a $60 million raise last September.

- Highnote, an embedded finance and payments technology company that emerged from stealth with $54 million in funding in September of 2021, is hiring for a head of customer success, senior core infrastructure engineer, senior data platform engineer, senior software engineer, and a technical writer. More details here.

- EarnIn is currently hiring across engineering, product, business development and finance among other departments in the U.S., LatAm, and Bangkok. It most recently raised a $125 million Series C.

- Branch, a full-stack home and auto insurer that leverages data and technology, currently has more than 30 open roles throughout the company. The company raised $147 million at a $1.05 billion valuation last June.

- Corporate spend management company Ramp, which was valued at $8.1 billion last year, is hiring for 30+ roles.

- NorthOne, a small business-focused neobank, is currently hiring for nine roles in product, engineering, marketing, and compliance. The company raised $67 million in Series B funding last October.

- Nova Credit, a consumer-permissioned credit bureau, has six open positions that are remote across engineering and marketing. In September, it received a $10 million investment from HSBC Ventures.

- Silicon Valley–based neobank Upgrade is hiring for over two dozen roles. The company raised $280 million at a $6 billion valuation in 2021 and says it offers “affordable and responsible” credit, mobile banking, and payment products to consumers.

- Prodigal, which has developed a cloud-based consumer finance intelligence solution that analyzes agent and customer conversations, is hiring for several roles across most of its departments, including for a VP of sales and chief of staff.

- Stake, a digital real estate investment platform in MENA that raised $8 million last August, has 13 current positions to fill between Dubai and Cairo. More details can be found on its careers page.

- Viva Wallet has a total of 188 openings across Europe. JPMorgan acquired a stake in the Athens-based SMB-focused fintech in early 2022.

It was a busy week in the world of fintech, so I’m looking forward to some downtime this weekend and hope you’re enjoying some, too! Let me end with a personal photo taken at the end of a walk the other day. Gotta admit that Austin sunsets are pretty breathtaking. Until next week, take good care. xoxoxo, Mary Ann

Image Credits: Mary Ann Azevedo / Austin sunset

Sequoia and Andreessen Horowitz invested more in fintech than any other sector in 2022 by Mary Ann Azevedo originally published on TechCrunch

from https://ift.tt/hRaUfWG

via

Technews

(@esthercrawford)

(@esthercrawford)